Township of Severn issues property tax bills in January and June of each year.

Payment due dates

The tax payment due dates are located on your tax bill. The interim tax bill is issued in January and the payment due dates are:

The final tax bill is issued in June and the payment due dates are:

Late penalties

If we don't receive your property tax payment by the appropriate due date, a late payment penalty of 1.25% will be issued on the day following the due date. An additional 1.25% will be charged each month that you fail to pay your property taxes.

If you haven’t received a tax bill, please contact us and we can help. Property owners are liable for property taxes and late penalties, even if you didn’t receive a tax bill.

Register for your eServices account

Our eServices portal will allow you secure online access to your property tax, water and sewer billings. Users can view, manage, and pay bills online, apply for and purchase permits, and report a concern or by-law complaint.

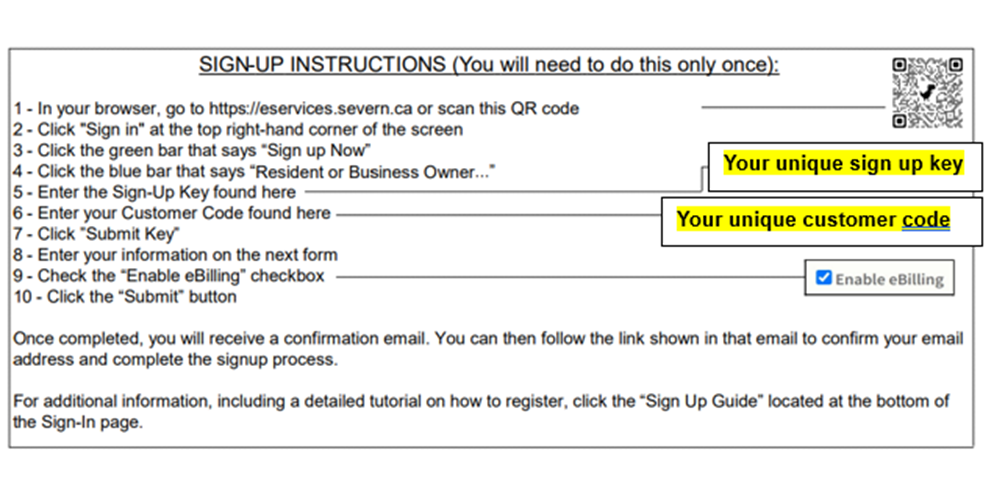

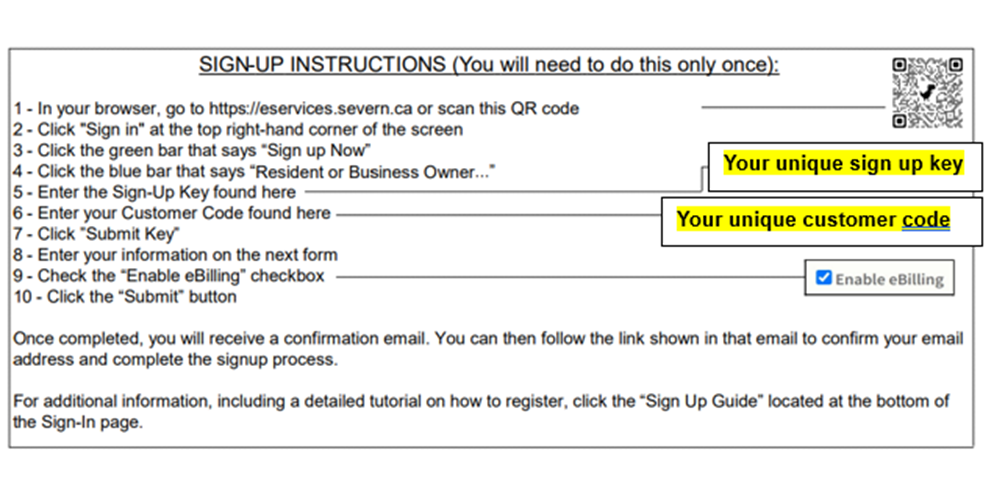

How to register

You will find detailed instructions on how to register for your eServices account on the back of your most recent property tax bill.

There is a unique sign-up key and customer code located on the back of your bill that you will need to enter to create your account at https://eservices.severn.ca.