Due to the recent strike action by the Canadian Union of Postal Workers, mail service will likely be disrupted. Please remember, all penalties, interest, and fines still apply, and we can't make exceptions for late payments sent through the mail or those that are delayed due to the postal strike.

Township of Severn issues property tax bills in January and June of each year.

Important account notice

Account numbers were changed in 2024 as we upgraded to a new financial system. If you pay your tax bill at your bank, whether in person at the teller, using online apps, or at a bank machine, you are required to update your account number.

Numerous letters have been sent to account holders to request that the account number be updated. If you have not yet updated your account number, please do so before your next payment(s).

Payments made with the old account number will be subject to a $10 administrative fee with each transaction.

If you are registered for our pre-authorized payment plan, no action is required as your account number was updated by our staff.

If you need assistance to update your account number, please connect with your bank or financial institution directly. Our staff cannot change your banking information on your behalf.

Payment due dates

The tax payment due dates are located on your tax bill. The interim tax bill is issued in January and the payment due dates are:

The final tax bill is issued in June and the payment due dates are:

Late penalties

If we don't receive your property tax payment by the appropriate due date, a late payment penalty of 1.25% will be issued on the day following the due date. An additional 1.25% will be charged each month that you fail to pay your property taxes.

If you haven’t received a tax bill, please contact us and we can help. Property owners are liable for property taxes and late penalties, even if you didn’t receive a tax bill.

Register for your eServices account

Our eServices portal will allow you secure online access to your property tax, water and sewer billings. Users can view, manage, and pay bills online, apply for and purchase permits, and report a concern or by-law complaint.

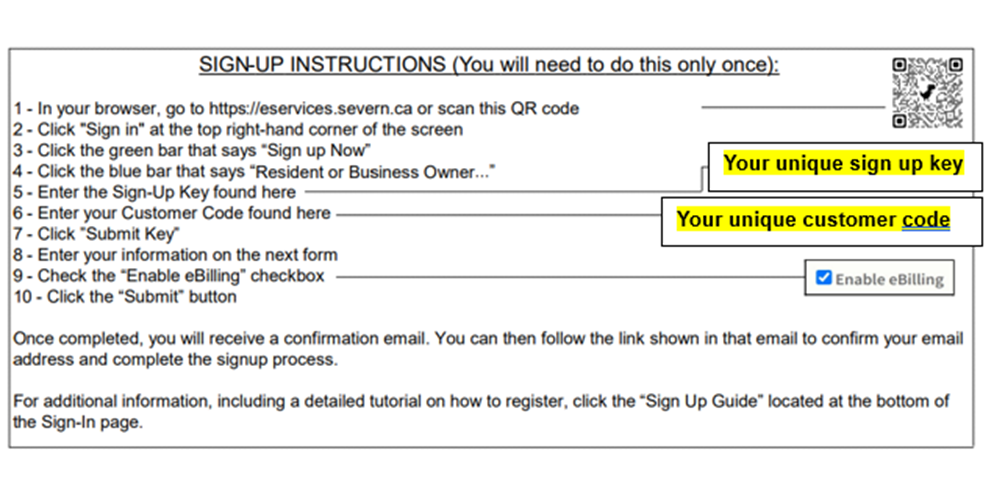

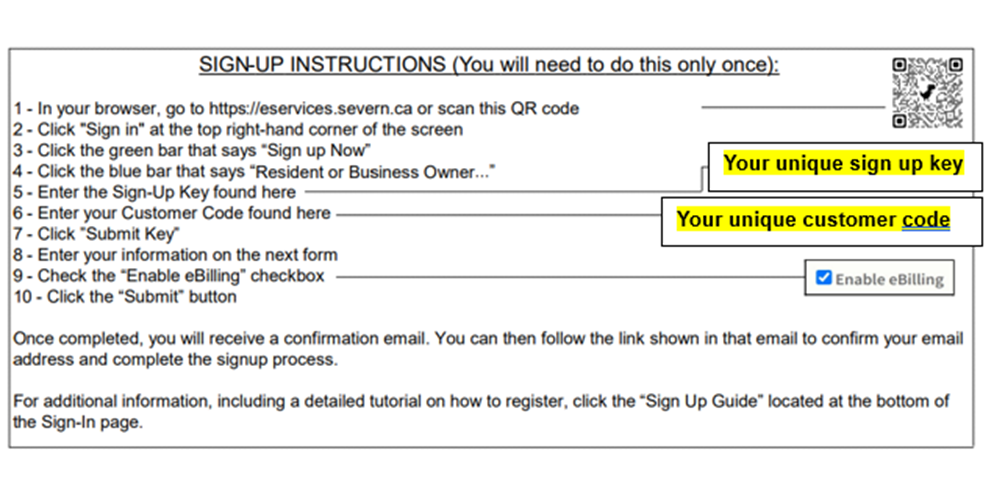

How to register

You will find detailed instructions on how to register for your eServices account on the back of your most recent property tax bill.

There is a unique sign-up key and customer code located on the back of your bill that you will need to enter to create your account at https://eservices.severn.ca.