June tax bills issued by regular mail to all properties in transition to new E-Services portal

All property owners to receive tax bills by regular mail

Township of Severn has launched our new E-Services portal that will allow our community to access tax bills and water and sewer billings online in one secure account.

Service for our previous e-billing site (E-Commerce) has been discontinued.

To continue receiving your tax bill by email, please register for a new user account on our new E-Services portal.

How to register

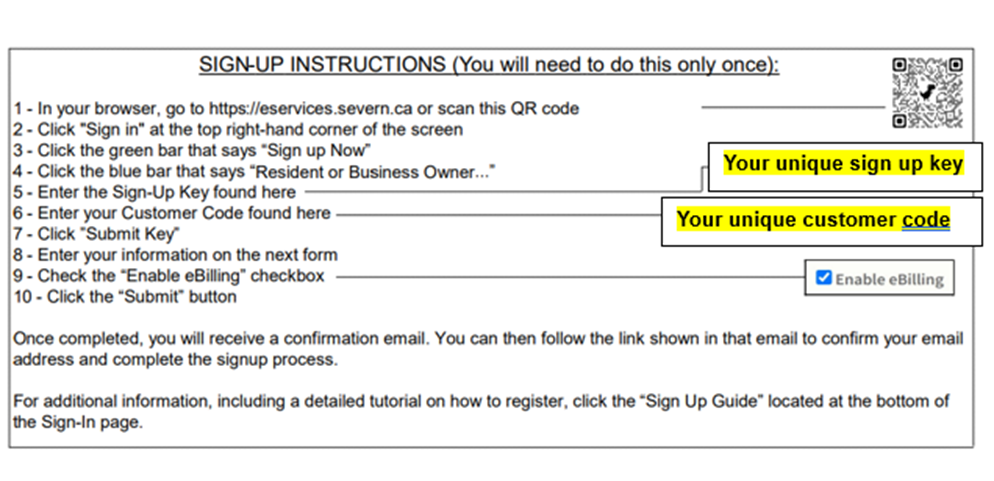

You will find detailed instructions on how to register for your E-Services account on the back of your June 2024 property tax bill.

There is a unique sign-up key and customer code located on the back of your tax bill that you will need to enter to create your account at https://eservices.severn.ca.

After you subscribe, you will be able to view your bill online and your bills will continue to be sent to you via email.

Visit the new E-Services portal to continue your e-billing service or to register as a new user

Tax bill due dates

Final tax bills are due in two instalments:

- August 8

- October 8

If you haven’t received your tax bill, please contact us and we can help. Property owners are liable for property taxes and late penalties, even if you didn’t receive a tax bill.

If we don't receive your property tax payment by the due date, a late payment penalty of 1.25% will be issued on the day following the due date. An additional 1.25% will be charged each month that your property taxes remain unpaid.

Payment options

You can pay your property taxes in a variety of ways.

If you were previously registered for our pre-authorized payment plan prior to June 2024 and the launch of our E-Services portal, your payment will be withdrawn as per your payment plan. If you would like to receive your bill by email only (paperless) please register for your new E-Services account.

| Online and telephone banking |

|

You can pay your property taxes through online banking at most Canadian banks. You will need to add your property taxes to your online banking. Please use the 19-digit roll number found on your tax bill (numbers only, no hyphens or spaces) and select Severn Township or Township of Severn as the payee. We recommend doing a keyword search for Severn. |

| By mail |

|

You can pay your taxes by mail. Please make your cheque payable to Township of Severn and mail to: Township of Severn We accept post-dated cheques for future payment due dates. |

| Credit card (Mastercard or Visa only) |

|

You can pay your property tax bill on the E-Services portal or in person at our Administration Office located at 1024 Hurlwood Lane in Severn with Mastercard or Visa only (we do not accept credit cards other than Mastercard or Visa). If you choose to pay using Mastercard or Visa, a two percent fee will be applied to your bill. The Township is required to pay a merchant fee (surcharge) to cover the cost of processing each credit card transaction. This fee is applied as a cost-recovery measure to only those transactions that are paid by credit card, and not to other forms of payment. |

| In person |

|

You can pay your taxes in person at the Administration Office located at 1024 Hurlwood Lane in Severn. We are open Monday to Friday from 8:30 a.m. to 4:30 p.m. We accept payments by cash, credit card (Mastercard or Visa only), debit, or cheque. This includes post-dated cheques for future payment due dates. Please make your cheque payable to Township of Severn. If you choose to pay using Mastercard or Visa, a two percent fee will be applied to your bill. The Township is required to pay a merchant fee (surcharge) to cover the cost of processing each credit card transaction. This fee is applied as a cost-recovery measure to only those transactions that are paid by credit card, and not to other forms of payment. After-hours paymentsYou can also place your property tax payment in the after-hours drop box located outside the front of the Administration Office. |

| At your bank |

| Property taxes can be paid at your bank simply by visiting your bank with your property tax bill. |

June Bulletin

The Severn Bulletin included with your tax bill contains important information for our community, such as:

- highlights of our community safety initiatives

- how to apply online for your fire permit

- summary of the 2024 budget

- tax deadlines and payment options

- tips for planning your building project

Stay up to date on our projects and programs by subscribing to our News and Notices. Visit our website to learn more or follow us on Facebook, X, or Instagram.

Staff contacts

Patti Detta

Taxation Officer

Phone: 705-325-2315 x225

Email Patti